Delving into Best Cigna Health Plans for Families and Small Businesses, this introduction immerses readers in a unique and compelling narrative, with a tone that is both engaging and thought-provoking from the very first sentence.

As we explore the realm of Cigna Health Plans tailored for families and small businesses, we uncover a plethora of key features, coverage options, and cost considerations that are vital for making informed decisions.

Overview of Cigna Health Plans

Cigna Health Plans offer comprehensive coverage options for families and small businesses, ensuring access to quality healthcare services.

Key Features and Benefits

- Wide network of healthcare providers for easy access to medical services

- Customizable plans to suit the specific needs of families and small businesses

- Wellness programs and resources to promote healthy living among members

- 24/7 customer support for assistance with any healthcare-related queries

Types of Health Plans Offered

Cigna offers a variety of health plans tailored for families and small businesses, including:

| Plan Type | Description |

|---|---|

| Health Maintenance Organization (HMO) | Focuses on preventive care and requires members to choose a primary care physician |

| Preferred Provider Organization (PPO) | Offers flexibility in choosing healthcare providers, both in and out of network |

| High Deductible Health Plan (HDHP) | Features lower premiums and a higher deductible, often paired with a Health Savings Account |

| Exclusive Provider Organization (EPO) | Similar to a PPO but restricts coverage to in-network providers only |

Coverage Options

When it comes to Cigna Health Plans, there are different coverage options available for families and small businesses, each tailored to meet their specific needs and requirements.

Family Coverage

- Medical Services: Cigna Health Plans for families typically offer comprehensive coverage for a wide range of medical services, including hospital stays, doctor visits, and emergency care.

- Prescription Drugs: Families can benefit from coverage for prescription medications, helping to reduce out-of-pocket expenses for essential drugs.

- Preventive Care: Cigna Health Plans prioritize preventive care for families, including routine check-ups, vaccinations, and screenings to promote overall well-being.

- Additional Benefits: Families may also enjoy additional coverage benefits such as mental health services, maternity care, and pediatric care to address specific family healthcare needs.

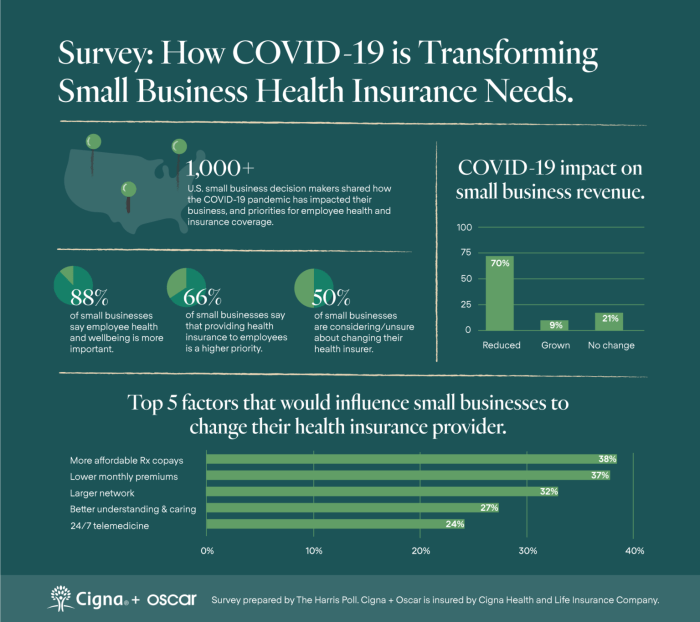

Small Business Coverage

- Medical Services: Cigna Health Plans for small businesses provide access to a network of healthcare providers for employees, covering essential medical services to support their well-being.

- Prescription Drugs: Small business plans include coverage for prescription drugs, ensuring that employees have access to necessary medications without incurring high costs.

- Preventive Care: Small businesses can offer preventive care benefits to employees, encouraging regular health screenings and wellness programs to maintain a healthy workforce.

- Additional Benefits: Small business plans may offer additional benefits such as telehealth services, employee assistance programs, and wellness incentives to promote employee health and productivity.

Cost and Affordability

When it comes to choosing a Cigna Health Plan for families and small businesses, understanding the cost factors is crucial. Let’s dive into how premiums, deductibles, and copayments work within these plans, and provide tips on optimizing costs.

Premiums

Premiums are the monthly payments you make to maintain your health insurance coverage with Cigna. The amount of the premium can vary based on factors such as the plan you choose, the number of individuals covered, and your location. It’s important to carefully compare different plan options to find one that fits your budget while providing adequate coverage.

Deductibles

A deductible is the amount you must pay out of pocket for covered services before your insurance plan starts to pay. With Cigna Health Plans, higher deductible plans often have lower monthly premiums, while lower deductible plans may have higher premiums.

Consider your healthcare needs and budget when choosing a plan with the right deductible for your situation.

Copayments

Copayments are fixed amounts you pay for covered services at the time of service, such as a visit to the doctor or a prescription medication. Different services may have different copayment amounts, so it’s important to understand these costs upfront to avoid unexpected expenses.

Look for plans that offer reasonable copayments for services you anticipate using regularly.

Optimizing Costs

Consider your healthcare needs

Choose a plan that covers the services you and your family are most likely to use.

Utilize preventive care

Take advantage of free preventive services included in many Cigna Health Plans to avoid costly medical issues down the road.

Compare plan options

Look at different plan features, premiums, deductibles, and copayments to find the best balance between cost and coverage.

Explore cost-saving programs

Cigna may offer programs like telehealth services or prescription drug discounts that can help you save on healthcare expenses.

Network of Providers

When it comes to Cigna Health Plans, one of the key aspects to consider is the extensive network of healthcare providers and facilities that are included in their coverage. This network plays a crucial role in ensuring that families and small businesses have access to quality healthcare services when they need them the most.

Wide Coverage for Comprehensive Care

- Cigna Health Plans have a vast network of doctors, specialists, hospitals, and clinics across the country, providing members with a wide range of options for their healthcare needs.

- By having a large network of providers, families and small businesses can benefit from access to various medical services, treatments, and procedures without having to worry about limited choices.

- Members can choose healthcare providers within the network based on their preferences, whether it’s proximity to their location, specialty, or specific medical needs.

Easy Access to In-Network Providers

- Members can easily find in-network providers through the Cigna website or mobile app, which offers a provider directory with detailed information on healthcare professionals and facilities.

- By choosing in-network providers, members can save on out-of-pocket costs and enjoy the benefits of their health plan without unexpected expenses.

- In case of emergencies or urgent care needs, members can quickly locate nearby in-network facilities for immediate medical attention and care.

Customer Satisfaction and Reviews

Customer satisfaction plays a crucial role in evaluating the effectiveness of health plans offered by Cigna for families and small businesses. Reviews and ratings from existing customers can provide valuable insights into the overall quality of services and coverage provided by Cigna Health Plans.

Sources for Customer Reviews and Satisfaction Ratings

- Official Cigna website: Cigna may feature customer testimonials and reviews on their website, providing a direct source of feedback from policyholders.

- Third-party review sites: Platforms like Consumer Reports, J.D. Power, and Yelp may host customer reviews and satisfaction ratings for Cigna Health Plans, offering unbiased opinions.

- Social media platforms: Customers often share their experiences with Cigna on social media channels like Facebook, Twitter, and Reddit, giving real-time feedback.

Common Feedback from Families and Small Businesses

- Positive remarks on comprehensive coverage options tailored to meet diverse healthcare needs of families and small businesses.

- Appreciation for the wide network of providers, ensuring easy access to healthcare services and specialists.

- Feedback on the user-friendly online tools and mobile apps for managing health plans and claims efficiently.

- Concerns regarding occasional delays in claim processing and reimbursement, impacting overall customer experience.

- Complaints about premium costs and out-of-pocket expenses, highlighting affordability challenges for some policyholders.

Impact of Customer Satisfaction Levels on Decision-making

Customer satisfaction levels can significantly influence the decision-making process for families and small businesses when selecting health insurance plans. Positive reviews and high satisfaction ratings may instill confidence in potential customers, assuring them of quality services and reliable coverage. Conversely, negative feedback and low satisfaction levels could deter individuals and businesses from choosing Cigna Health Plans, leading to a shift towards competitors with better customer satisfaction records.

Customization and Flexibility

When it comes to Cigna Health Plans for families and small businesses, customization and flexibility are key features that set these plans apart. These options allow individuals and companies to tailor their healthcare coverage to suit their specific needs and preferences.

Customization Options Available

- Choosing between different levels of coverage, such as basic, intermediate, or premium plans.

- Selecting specific add-ons or riders to enhance coverage for certain medical services or conditions.

- Customizing deductibles, copayments, and coinsurance amounts to align with budget constraints and healthcare needs.

Benefits of Customization

- A family with young children may opt for a plan that includes pediatric care and immunizations as priority coverage areas.

- A small business with a predominantly older workforce might choose a plan with extensive coverage for chronic conditions and preventive screenings.

- Customizing deductibles and copayments can help individuals and businesses manage out-of-pocket expenses more effectively.

Wrap-Up

In conclusion, the landscape of Best Cigna Health Plans for Families and Small Businesses is vast and full of possibilities. By understanding the nuances of coverage, costs, and customization, families and small businesses can navigate the healthcare terrain with confidence and assurance.

FAQ Resource

Are Cigna Health Plans suitable for both families and small businesses?

Yes, Cigna offers health plans that cater to the needs of both families and small businesses, providing comprehensive coverage options for each.

How can one optimize costs when selecting a Cigna Health Plan?

To optimize costs, individuals and businesses should carefully review premium, deductible, and copayment structures within Cigna Health Plans to choose the most cost-effective option.

What are some examples of customization options available in Cigna Health Plans?

Cigna Health Plans allow for customization such as selecting specific coverage areas, adjusting deductibles, and tailoring plans to meet unique healthcare needs of families and small businesses.