Delving into the realm of Free Medicare Advantage Plans: What’s Really Included?, embark on a journey filled with insights and clarity on this crucial topic.

Exploring the nuances of healthcare coverage and benefits, this paragraph sets the stage for a comprehensive discussion ahead.

Overview of Free Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C, are health insurance plans offered by private companies approved by Medicare. These plans provide all your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage and often include additional benefits such as vision, dental, hearing, and prescription drug coverage.

Types of Healthcare Services Covered

- Inpatient hospital care

- Outpatient hospital care

- Doctor visits

- Preventive services

- Prescription drugs

- Emergency and urgent care

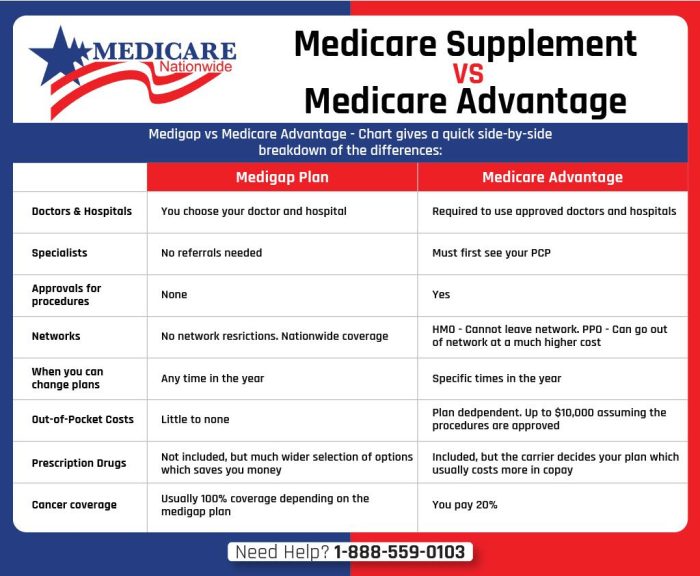

Difference Between Original Medicare and Medicare Advantage Plans

Original Medicare consists of Part A (Hospital Insurance) and Part B (Medical Insurance) provided by the government, while Medicare Advantage Plans are offered by private insurance companies approved by Medicare. One key difference is that Medicare Advantage Plans often include additional benefits beyond what Original Medicare covers, such as prescription drug coverage, vision, dental, and hearing services.

Benefits Included in Free Medicare Advantage Plans

When considering Medicare Advantage plans, it’s important to understand the benefits included in these plans. Here we will discuss common benefits, additional benefits, and compare free plans with paid plans.

Common Benefits

- Hospital stays coverage: Most free Medicare Advantage plans cover hospital stays, including inpatient care.

- Doctor visits: Free plans typically include coverage for visits to primary care physicians and specialists.

- Prescription drugs: Many free Medicare Advantage plans offer coverage for prescription medications.

Additional Benefits

- Vision coverage: Some free Medicare Advantage plans include benefits for routine eye exams, glasses, or contact lenses.

- Dental coverage: Certain plans may offer coverage for dental services like cleanings, fillings, and extractions.

- Hearing coverage: Some free plans provide benefits for hearing exams and hearing aids.

Comparison of Benefits

- Free plans vs. paid plans: While free Medicare Advantage plans offer a range of benefits, including those mentioned above, paid plans may provide additional benefits like fitness programs, transportation services, or wellness programs.

- Out-of-pocket costs: Free plans often have lower monthly premiums and out-of-pocket costs compared to paid plans, making them more affordable for some individuals.

Limitations and Restrictions of Free Medicare Advantage Plans

When it comes to free Medicare Advantage plans, there are certain limitations and restrictions that beneficiaries need to be aware of. These can impact the choice of providers, coverage for treatments, and out-of-pocket costs.

Provider Networks and Service Areas

- Free Medicare Advantage plans often have specific provider networks, meaning beneficiaries may need to choose healthcare providers within the plan’s network to receive coverage.

- Service areas may be limited, especially for plans that are offered at no cost, so beneficiaries may need to reside in a particular geographic region to be eligible for these plans.

Coverage Restrictions for Treatments or Procedures

- Some free Medicare Advantage plans may have restrictions on coverage for certain treatments or procedures that are considered elective or not deemed medically necessary.

- Beneficiaries should carefully review the plan’s coverage details to understand what treatments or procedures may not be covered under the plan.

Out-of-Pocket Costs or Copayments

- While free Medicare Advantage plans do not charge a premium, beneficiaries may still be responsible for out-of-pocket costs such as copayments, coinsurance, or deductibles for covered services.

- These costs can vary depending on the specific plan and the services received, so it’s important for beneficiaries to understand their financial responsibilities under the plan.

Enrollment Process and Eligibility Requirements

When it comes to enrolling in a free Medicare Advantage Plan, there are specific eligibility criteria that individuals must meet. Here, we will detail the requirements for eligibility and provide a step-by-step guide on how to enroll in a plan.

Eligibility Criteria for Enrolling in a Free Medicare Advantage Plan

In order to enroll in a free Medicare Advantage Plan, individuals must meet the following eligibility requirements:

- Be eligible for Medicare Part A and Part B.

- Reside in the plan’s service area.

- Not have end-stage renal disease (ESRD) with some exceptions.

Step-by-Step Guide on How to Enroll in a Plan

- Visit the Medicare website or call 1-800-MEDICARE to find and compare available plans in your area.

- Select a Medicare Advantage Plan that meets your healthcare needs and preferences.

- Contact the plan directly to enroll, or enroll through the Medicare website.

- Provide the necessary information and complete the enrollment process.

- Review and understand the coverage and costs associated with the plan.

Deadlines or Specific Enrollment Periods

It is important to note that there are specific enrollment periods for Medicare Advantage Plans. The Annual Enrollment Period (AEP) is from October 15 to December 7 each year, during which individuals can enroll, switch, or disenroll from a plan.

Additional Considerations for Choosing a Free Medicare Advantage Plan

When selecting a free Medicare Advantage plan, there are several key factors to keep in mind to ensure you choose the best option for your healthcare needs. From premiums and deductibles to provider networks, each aspect plays a crucial role in determining the suitability of a plan for you.

Premiums and Deductibles

- It’s essential to consider the monthly premiums and annual deductibles associated with each Medicare Advantage plan. While some plans may offer lower premiums, they might have higher deductibles, and vice versa. Evaluate your healthcare budget and anticipated medical needs to determine which balance of premiums and deductibles works best for you.

- Remember that lower premiums might result in higher out-of-pocket costs for services, so weigh your options carefully.

Provider Network

- Reviewing the plan’s provider network is crucial to ensure that your current healthcare providers, including doctors, specialists, and hospitals, are included in the network. Confirming that your preferred providers participate in the plan can help you avoid unexpected costs or the need to switch healthcare providers.

- Consider whether you are willing to change providers if your current ones are not in the plan’s network. Assess the accessibility and quality of in-network providers to make an informed decision.

Comparing Different Plans

- Take the time to compare different Medicare Advantage plans based on their benefits, coverage options, cost-sharing requirements, and additional perks, such as vision or dental coverage.

- Utilize online tools, plan brochures, and resources provided by Medicare to compare plan details side by side. Pay attention to copayments, coinsurance rates, and coverage limitations to find a plan that aligns with your healthcare needs.

- Consider reaching out to a Medicare counselor or insurance agent for personalized assistance in comparing plans and making an informed decision.

Cost Savings and Assistance Programs

Individuals with free Medicare Advantage Plans may have access to various cost-saving opportunities and assistance programs to help with healthcare expenses.

Cost-saving Opportunities

- Many Medicare Advantage Plans offer $0 monthly premiums, helping beneficiaries save on out-of-pocket costs.

- Some plans provide coverage for services not included in Original Medicare, such as vision, dental, and prescription drugs, potentially saving individuals money on these additional expenses.

Assistance Programs

There are various assistance programs available to help individuals with premiums, copayments, or other healthcare costs:

- Medicare Savings Programs: These programs help pay for Medicare premiums and, in some cases, other costs like deductibles and coinsurance.

- Extra Help/Low-Income Subsidy: This program assists with prescription drug costs for individuals with limited income and resources.

Financial Assistance Resources

For those seeking financial assistance or counseling, there are resources available:

- State Health Insurance Assistance Programs (SHIP): SHIP provides free, personalized help to individuals and families with Medicare.

- Medicare.gov: The official Medicare website offers information on financial assistance programs and resources for beneficiaries.

Summary

Concluding our exploration of Free Medicare Advantage Plans: What’s Really Included?, we unravel the key takeaways and essential points discussed, leaving you with a deeper understanding of this subject.

Clarifying Questions

What are Medicare Advantage Plans?

Medicare Advantage Plans are offered by private companies approved by Medicare to provide Medicare Part A and Part B benefits.

Are vision and dental services covered under Free Medicare Advantage Plans?

Some plans may offer additional benefits like vision and dental coverage, but it varies by plan. It’s important to check the specifics of each plan.

What are the eligibility criteria for enrolling in a Free Medicare Advantage Plan?

To enroll, you typically need to have Medicare Part A and Part B, live in the plan’s service area, and not have end-stage renal disease (with some exceptions).

Are there restrictions on coverage for specific treatments or procedures?

Some plans may have restrictions on coverage for certain treatments or procedures, so it’s crucial to review the plan details carefully.

How can individuals compare different Free Medicare Advantage Plans?

Individuals can compare plans based on premiums, deductibles, coverage for specific services, and the provider network to find the best fit for their needs.